By Jen Saarbach & Kristen Kelly, Co-Founders of The Wall Street Skinny

I barely have a social life.

But fittingly, the one day that I hop on a flight for a girls’ trip to the Caribbean with my college roommate, the market melts down. You should have seen me desperately trying to connect to the internet on a ferry to figure out what was going on in the Japanese bond market while questions were flooding in from our DMs.

I’ve finally got a WiFi connection, and the markets appear to have come to their senses. So let’s talk about it.

Japan has, for all of my adult life, been the land of the low yields. The Japanese central bank has used long end bond purchases (“Quantitative Easing”) for decades to fight deflation and support the economy. At its height, the BOJ owned something like 50% of all the outstanding government bonds in the market. The latest round of QE ran from 2013 to 2024, when the central bank reversed course with a multi-year tapering program, slowing the pace of its purchases and hiking short term interest rates. When this commenced at a faster-than-expected pace in 2024, it shocked the markets, causing a chaotic unwind of the “carry trade”, where investors borrow on the cheap in JPY where interest rates have traditionally been lower, and lend (invest) in USD, EUR, GBP, or other currencies where rates are higher.

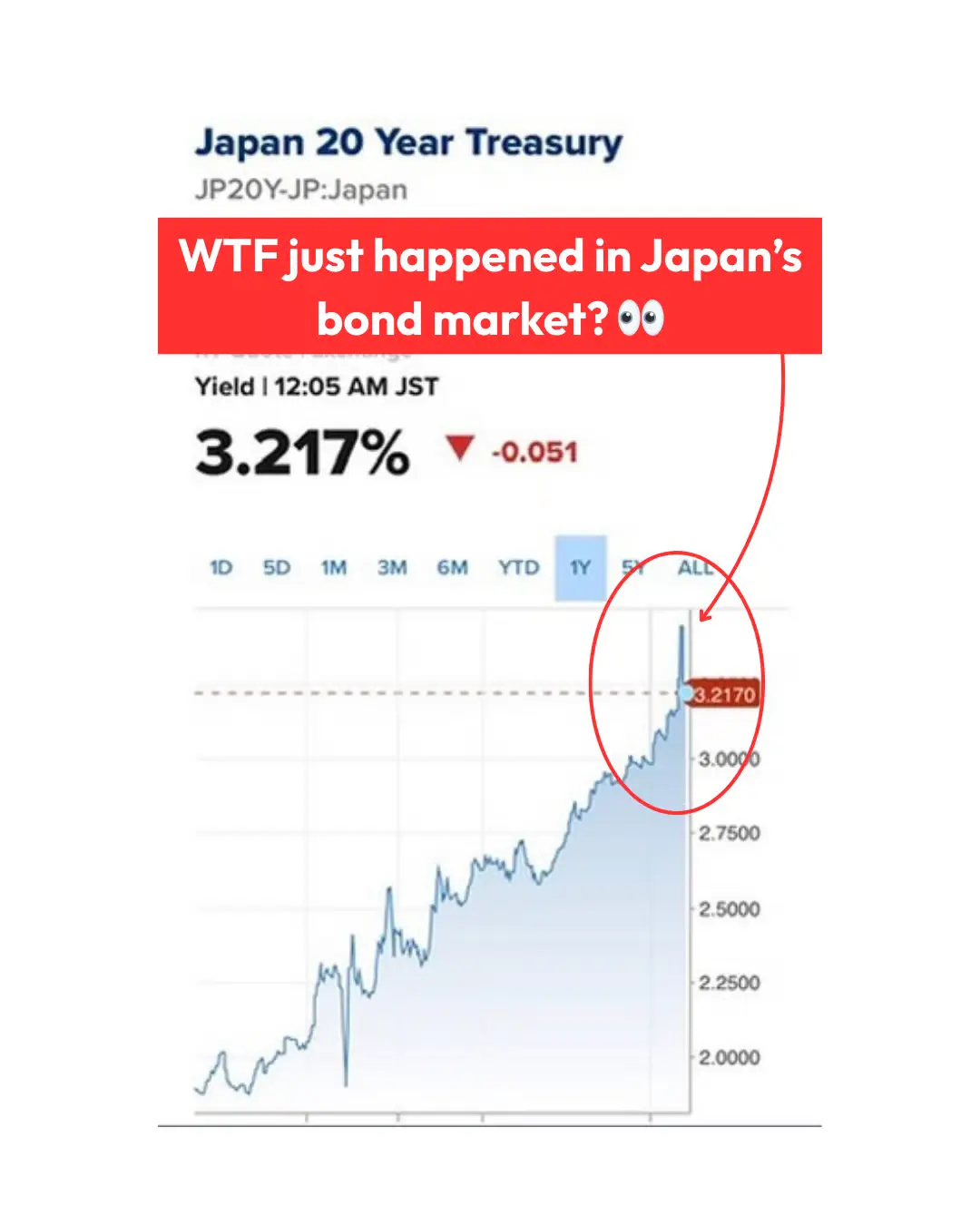

Since August of 2024 (with a few notable exceptions), long end JGB yields have been on a one way train higher. With the BOJ stepping back, investors haven’t exactly rushed in to fill that gap in demand.

And that’s not just the story for Japan. It’s been the case for nearly all G7 sovereign debt markets due to both structural and strategic reasons (which we discussed specifically with the Dutch pension funds), save the US. In fact, we’ve talked about this long end term premium building since our first newsletter article of the year. As governments continue the trend of fiscal irresponsibility, meaning, more spending with no plan to bring money in to pay those debts off, investors continue to demand higher and higher interest rates as compensation for investing in increasingly risky bonds.

But Japan has given us real cause for concern. In May of last year, we had our first warning signs of an investor boycott when the government auctioned off their regularly scheduled 20 year and 40 year bond issuances.

If you’re not familiar with bond auctions, they don’t all work like auctions at Christie’s and Sotheby’s, where the highest bid wins the painting and everyone else misses out. Some bond auctions, like 10 year JGBs, are multiple-price auctions. If the bonds are trading at 4.00% heading into the auction and you really want them, so you bid 3.95% to make sure you get them, reminder price and yield are inverted so a higher price means you’re willing to accept a lower yield, you buy them at 3.95% when someone else who cares less might only bid 3.96% and get them there. Someone who bids 4.02% might not get any bonds if they are all spoken for at lower yields. But there’s a winner’s curse, where you feel like a dummy buying at 3.95% when everyone else gets 3.99%.

20- and 40-year JGB auctions however, like all nominal Treasury bonds, are Dutch auctions. Investors from all over the world submit the lowest yield (meaning, highest price) they are willing to accept for their investment. All the bonds have to be sold. So it’s not the most expensive bid that wins — rather, the lowest yield that makes sure ALL BONDS are spoken for is where the entire auction clears. Let’s say bonds are trading at 4.00% heading into an auction. If the most desperate investor bids 3.95% and the most skeptical investor willingly bids 3.99%, all bonds are sold at 3.99%. In that case, the auction is said to be “stopping through” by a margin of 1 basis point. But if investors aren’t particularly interested, and instead are only willing to buy the bonds at cheaper levels, say 4.01%, those bonds will be issued at higher yields than the market anticipated. A bond trading at 4.00% heading into an auction that clears at 4.01% is said to have “tailed” by 1 basis point. A “tail” means investor demand was weaker than anticipated.

Both the 20 year and 40 year JBG bond auctions in May of 2025 tailed by over a basis point, margins not seen in long end JGBs since the 1980s. Goldman research at the time called it “the canary in the global duration coal mine”.

On November 21, 2025, the Japanese government announced a JPY21.3tr stimulus package, aka, more spending. Yet, no real plan to pay for said spending.

So this all came to a head on Tuesday, when the 20 year JGB auction tailed by over 2 basis points, with a statistically low bid-to-cover ratio. Meaning, fewer buyers showed up, and they were only willing to buy bonds at cheaper yields than where the bonds were trading prior to the auction.

This buyer boycott had massive repercussions. Long dated JGBs sold off (meaning, yields rose) by 20-30 basis points. This was a “black swan” level event in terms of the order of magnitude of the move. But more importantly, the global bond markets took this as a definitive referendum on fiscal irresponsibility, and it sparked immediate contagion in other G7 sovereign debt markets.

[Image Caption: Black swan spotted in JGBs…]

Now, anecdotally, whenever there’s a big move in the Japanese markets, it tends to be outsized in nature because liquidity is thin in the overnight markets. If the move happens on a Monday, or in this case, the Tuesday after a US holiday, forget about it, all bets are off. To be honest, it’s days like these that I was GLAD to be in transit, because when you’re watching the screens, it can feel like the world is ending. Sure enough, within 24 hours markets had regained their senses, retracing much of the move.

But like we’ve been saying since the beginning of the year, questions about who will show up for the long end of global bond curves have yet to be answered. If anything, we now have more concerning data points to show us just how fragile G7 bond markets are under current fiscal regimes.